News

New research projects to tackle key vulnerability and policing challenges

The ESRC Vulnerability & Policing Futures Research Centre has funded one out of four new research projects at the School of Law, led by an Early Career Researcher (ECRs), to address social issues.

Alumni Spotlight: Neoma Vasdev Gupta's journey from Leeds to leadership

Alumna of the School of Law at the University of Leeds makes waves in legal, political, and social spheres in India.

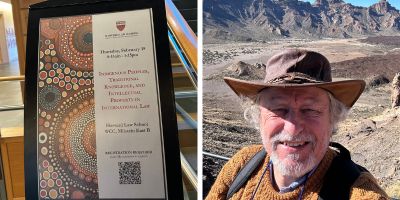

School of Law Professor speaks at Harvard conference on Traditional Knowledge and protecting the rights of Indigenous Peoples

In February 2024, Professor Graham Dutfield gave a paper at the Harvard conference 'Indigenous Peoples, Traditional Knowledge and Intellectual Property in International Law.'

'The most significant cyber threat facing the UK': the School of Law’s Professor Wall is tackling ransomware through his research

Professor David Wall’s research has been cited in a Parliament report on ransomware.

Tackling institutional racism within the higher education sector: Dr Nick Cartwright contributes vital resource towards decolonising the curriculum

Associate Professor Dr Nick Cartwright has developed a resource for Sage Publishing as part of their new Research Methods collection.